Debt & Deficit Task Force

During my first term in Congress, I convened a Debt and Deficit Task Force with local leaders from across Utah to create a framework of solutions for how elected officials can incorporate Utah’s fiscally responsible values in the federal budgeting process. The Task Force still meets regularly to discuss spending issues and solutions to our crippling federal debt and how necessary reforms can keep the American Dream within reach for the next generation.

In April of 2022, the Debt and Deficit Task Force released a recommendations document to advance and foster constructive dialogue on how to address our nation’s debt and deficit crisis with Utah’s fiscally sound policymaking perspective. The main pillars of the Task Force’s first solutions-based document are:

- Grow the economy

- Save and strengthen vital programs

- Focus America’s spending

- Fix Congress’s budget process

I have shared this document with my colleagues on the Ways and Means and Budget committees as we craft solutions to rein in federal spending and get our fiscal house back in order. Read the document HERE!

I am passionate about educating Utahns about the need to rein in our federal spending and get our fiscal house in order. Check out my “The Moore You Know” video on this topic here:

Important Debt and Deficit Information:

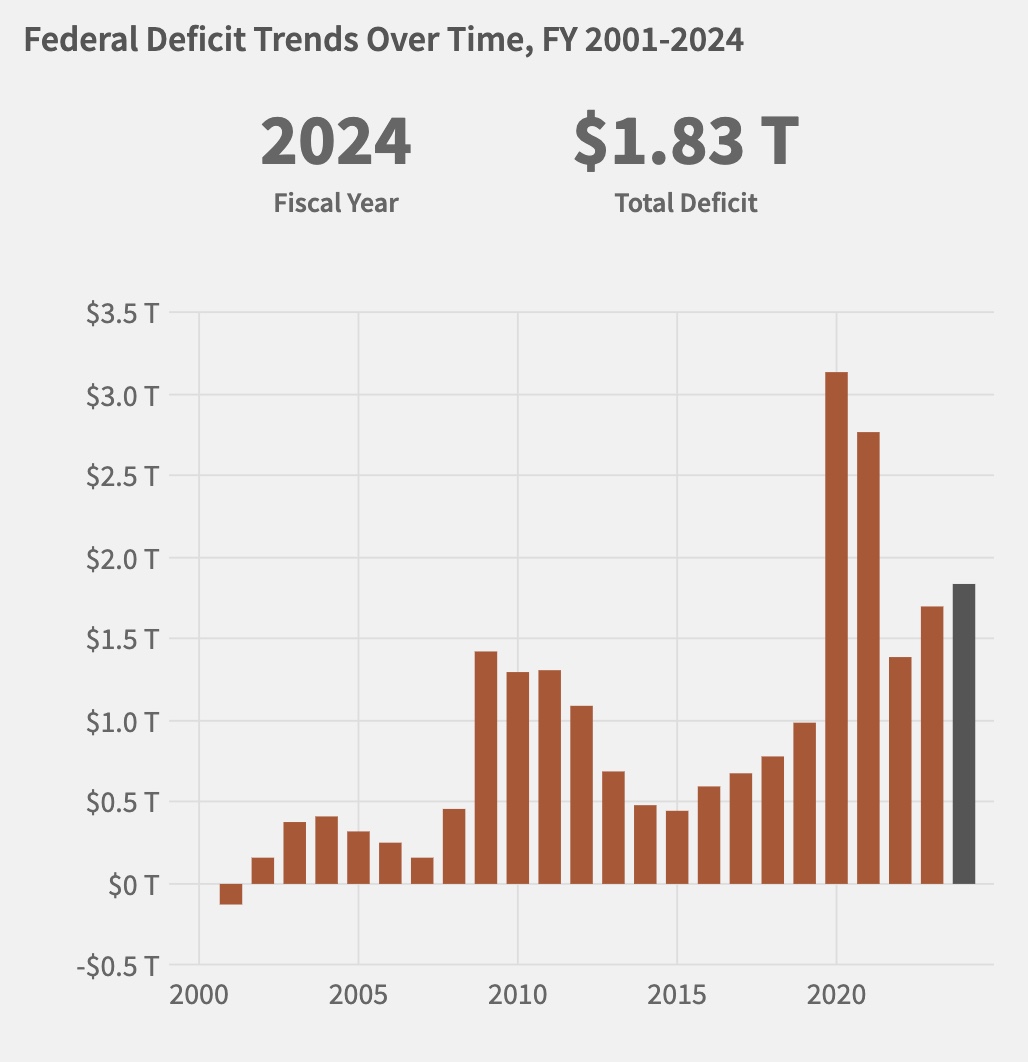

- The national deficit is how much money the federal government spent versus how much revenue it collected. For example, in Fiscal Year 2024, the federal government spent $6.75 trillion but only collected $4.92 in revenue, creating a national deficit of $1.83 trillion.

Chart credit: The U.S. Treasury Department

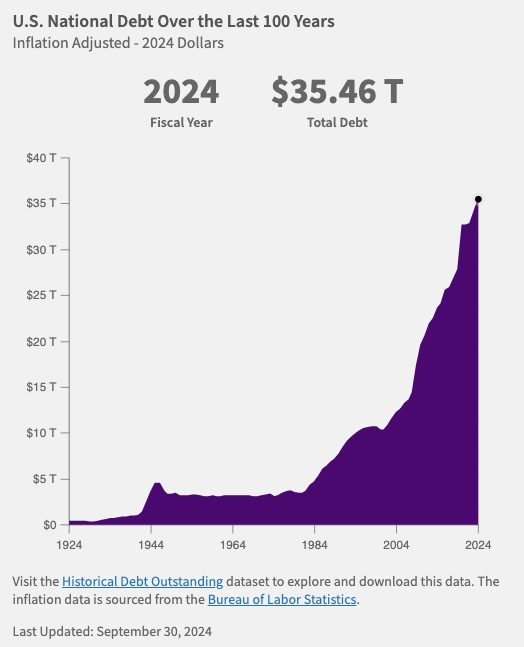

- The national debt is how much the federal government must borrow by selling Treasury Department bonds, bills, and other securities, along with interest owed to investors who purchased those securities. Higher deficits mean more debt.

Chart credit: The U.S. Treasury Department

- Comparing our nation’s gross domestic product (GDP) to our national debt is commonly referred to as our debt to GDP ratio. Used as an indicator of our nation’s fiscal health, this ratio compares our debts to our GDP output, demonstrating our nation’s ability to repay its debts. Our current ratio is 1.23, far past the healthy target ratio of 0.77 (as determined by the World Bank).

Data Source: Bureau of Labor Statistics

- As of February 2025, the national debt was over $36.4 trillion dollars—the highest in American history. Meanwhile, our budget revenue is $4.9 trillion, and our outlays are $6.75 trillion, creating a deficit of over $1.8 trillion.

- Mandatory spending is determined by law and is not subject to the annual appropriations process. This spending is often driven by benefit formulas or eligibility criteria and includes entitlement programs, such as Social Security and Medicare. Mandatory spending takes up approximately two-thirds of annual federal spending, and Congress does not regularly vote on these spending amounts.

- Discretionary spending is determined by the U.S. Congress each year in the budget and appropriations process. According to the Congressional Budget Act, this process is intended to start with the President’s submission of his budget proposal by the first Monday in February. The appropriations process determines spending for defense, education, transportation programs, and much more. Congress votes on these spending measures annually, and this spending only comprises about a quarter of federal spending.

- Net interest is a function of the size of the debt and current interest rates. We are currently spending more on our net interest than we are our national defense.

- The bottom line: The federal government must cut back on federal spending. Reducing our debt-to-GDP ratio and getting our national debt under control is critical to our national security and to our ability to grow the economy and help families thrive. Congress must also reform the annual budgeting process so we can more effectively manage federal spending.

The Debt and Deficit Task Force is working to put together another set of substantive and viable recommendations that I can incorporate into my legislative work so our federal government can get our fiscal house back in order. Follow along on Twitter, Facebook, and Instagram @RepBlakeMoore and sign up for my weekly e-newsletter HERE to stay up to date on our efforts.

To learn more about our national debt and deficit, check out these resources for further data, analysis, and information: